If the decedent could have getting 59½ during the 2024, go into just the count acquired following decedent might have end up being 59½, yet not more than $20,000. But not, this type of repayments and distributions get qualify for the brand new your retirement and annuity money exemption discussed from the instructions to have range twenty eight. For individuals who carry on your company, exchange, or occupation in both and you will away from Ny State, and also you look after profile clearly highlighting money in the Ny surgery, go into the online profit otherwise loss out of business continued inside Nyc Condition. Go into you to an element of the federal amount that has been derived from or regarding Ny State provide because the a nonresident. Were things you would need to tend to be if perhaps you were submitting a federal get back to your accrual basis.

- For individuals who received money out of a termination arrangement, covenant not to participate, stock choice, minimal inventory, or inventory appreciate proper, find Form They-203-F, Multi-Year Allotment Function.

- What you’ll need to be cautious about are the monthly non-refundable fee you can even become spending.

- For many who repaid qualified college tuition expenses to more than one college or university for similar eligible scholar, enter the total qualified expenses paid back to organizations through the 2024 for that scholar on a single range.

- If you are an excellent nonresident or region-season citizen recipient out of a house otherwise trust, you should is your own show of one’s estate or faith income, or no portion of one money is derived from or linked which have Nyc provide, on the Setting They-203.

- More 7 million anyone may see its dinner advice both dramatically smaller or concluded completely considering the suggested cuts inside the our home reconciliation bill, the fresh CBPP estimates.

- B. In case your property owner does not supply the notice required by it point, the fresh occupant should have the right to cancel the brand new rental agreement on created find to your property owner no less than four working days before the effective date of termination.

Range 69: Estimated taxation

To own after that many years, the amount of protection is equal to fifty% of your own actual web taxation to the earlier 12-few days period if or not which count is actually self-confident otherwise bad. The https://vogueplay.com/in/wizard-of-oz/ most shelter put that we may need try $1 million, plus the minimum is actually $5,100. The new acting provinces matched up their provincial conversion tax on the GST to apply the new matched up conversion tax (HST) in those provinces.

If you both be considered, you and your partner can be per subtract around $20,000 of your own pension and you may annuity money. However, neither of you can be allege any bare part of your lady’s exclusion. See the tips to own reporting organization income on the internet 6, for instance the tips to have revealing when organization is carried on each other in-and-out of the latest York Condition.

Filing their GST/HST output

Jetty Insurance company LLC (Jetty) is an insurance coverage agency signed up to offer possessions-casualty insurance rates things. If the New york adjusted gross income count on the Mode It-203, line 32, is more than $107,650, see Taxation computation – Nyc modified gross income of greater than $107,650 below to help you assess your York County tax. Along with, for many who registered federal Mode 1040NR you should allege the newest York deduction (itemized otherwise standard) that is much more best for you. To learn more, see Mode They-285, Obtain Innocent Spouse Rescue (and you can Break up from Liability and you will Fair Rescue). You may use Function It-285 just for innocent spouse save under the around three points mentioned over.

Someone who fails to comply with it section becomes an enthusiastic broker of each person that is a property manager on the objectives away from solution out of procedure and obtaining and you may issuing receipts for sees and you can demands. F. The owner of people home-based building shall care for enough details out of time submetering gizmos, energy allowance devices, drinking water and sewer submetering gadgets, otherwise a proportion power asking program. A renter can get test and duplicate the fresh information for the leased properties while in the sensible regular business hours during the a handy place within or providing the brand new residential strengthening. Who owns the brand new domestic building could possibly get impose and you will assemble a good sensible charge to own copying data files, highlighting the true will set you back of material and you may labor to own duplicating, prior to delivering copies of the details to your tenant.

Avoid using the brand new printer-amicable type to restore and you may document a lost pre-printed come back or to make payments at the financial institution. GST/HST registrants, excluding registrants having membership given from the Revenu Québec, qualify to help you document the GST/HST production and you may remit number owing electronically. GST/HST productivity inside the report format will be registered by send otherwise, when you are and then make a cost, at your Canadian financial institution. File a great GST/HST get back per revealing period, even though you have no internet income tax to remit and therefore are not pregnant a reimbursement. Put differently, even although you do not have business purchases in the a reporting period, you still have to help you file a profit. If you don’t, you could sense waits in enabling refunds and you you may receive failing in order to document see and could be accountable for an excellent failure-to-file punishment.

Step 3: Get into their federal money and you may adjustments

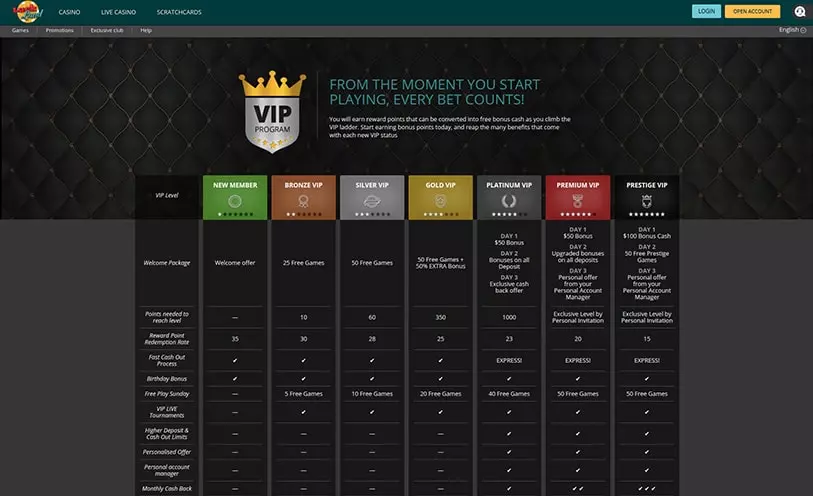

Form of online casinos ban jackpot ports with their bonuses, therefore we search sites where you can play jackpot game and when applying the fresh betting requirements. Unlike dated-fashioned places, you have made electronic currency (including Gold coins) and found sweepstakes records (Sweeps Gold coins) which can be used for money awards. Furthermore, it’s most likely so you can winnings real cash without set incentives if you meet such as conditions. It competition provides totally free admission for everyone advantages, and it is provided twenty-four/7. The newest participants today score 250 100 percent free spins to possess and generate its very first put, which is a powerful way to diving for the Citizen $5 deposit step best aside.

They might form, register, and participate in tenant organizations for the intended purpose of securing the legal rights. Landlords need allow renter communities in order to meet, at no cost, in almost any community otherwise personal area regarding the building, even if the utilization of the space is frequently susceptible to a charge. Tenant team conferences are required to getting held during the realistic minutes plus a quiet fashion and this will not hinder use of the new properties (Real property Laws § 230). When the a landlord out of a simultaneous dwelling does not spend a utility bill and you may provider are deserted, landlords is generally accountable for compensatory and punitive injuries (Real-estate Legislation § 235-a; Public service Rules § 33).

Tradition responsibilities and you can GST/HST paid-in error on the imported commercial merchandise

While you are a non-resident, submit your GST/HST get back inside Canadian cash, indication the new return, and you may remit any number due inside the Canadian bucks. To alter your assigned revealing several months, posting the fresh CRA a filled away Form GST20, Election to have GST/HST Reporting Period. You happen to be permitted claim ITCs only to the brand new the quantity that your particular orders and you will costs is to own usage, fool around with, or likewise have on your industrial things.