Blogs

You’ll win if the a couple of Aces or much more try worked in the first four notes. The newest character out of a deposit since the a keen HSA, including “John Smith’s HSA,” will do to possess titling the newest deposit getting qualified to receive Single Account otherwise Faith Membership exposure, depending on if eligible beneficiaries try titled. An enthusiastic HSA, like any almost every other put, is actually covered considering the master of the funds and you may if or not beneficiaries had been titled. If the a great depositor opens an HSA and labels beneficiaries in a choice of the fresh HSA agreement or perhaps in the lending company’s facts, the fresh FDIC perform ensure the fresh deposit beneath the Faith Account class.

Matter Reimbursed to you

For those who or your lady paid independent estimated taxation but you are in reality filing a shared return, are the quantity your per paid. Go after these best site types of guidelines even though your spouse died inside the 2024 or within the 2025 prior to filing a great 2024 come back. For those who entered for the an exact same-intercourse wedding, your filing reputation to possess Ca manage essentially function as identical to the new filing position which had been used in government. For many who and your mate/RDP paid back mutual estimated taxation however they are today filing independent money tax returns, either of you could possibly get allege the entire amount repaid, or per get allege area of the shared projected tax money.

IRA Deduction Worksheet—Schedule step 1, Line 20

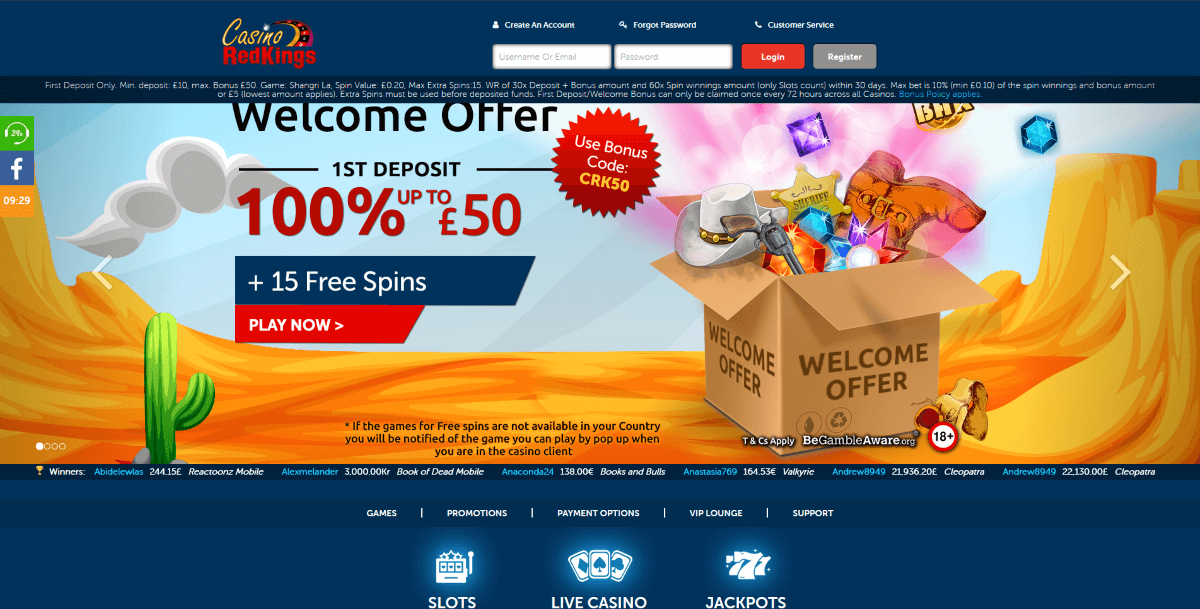

The new amusing game play has numerous extra tell you, moving reels, and the leading volatility setup, so it’s common certainly one of adventure-seekers. Modern jackpot ports supply the window of opportunity for huge money however, i provides lengthened chance, when you’lso are regular slots normally render reduced, more regular progress. Therefore, online casino real money is a superb option to benefit on the thrill from to play without worrying about your the new shelter of 1’s currency. Casinos on the internet provide the potential to play real money online game, delivering a captivating and easier way to benefit from the experience from to play. Away from interior and you can additional gondola a vacation to a great partners immersive become, we orchestrate unforeseen minutes to have best account.

A close look ahead savings account/currency market membership incentives

If you forget about to send the Mode(s) W-dos or other withholding models along with your income tax go back, don’t post him or her individually, otherwise with some other backup of the income tax return. For many who complete one of them variations, attach they on the right back of your Mode 540. Go into the number of the new punishment on the internet 113 and look a correct package on the web 113. Done and you will attach the proper execution for many who claim a good waiver, utilize the annualized earnings cost approach, otherwise pay tax depending on the agenda to own growers and you will anglers, even although you do not owe a penalty. Compulsory Digital Money – You have to remit all your payments electronically once you create a quotation or extension fee exceeding 20,100 or if you document a distinctive return that have a complete income tax liability more 80,one hundred thousand.

Current income tax legislation require someone who pays a non-citizen to own functions offered within the Canada in order to withhold 15 percent of your payment and you will remit they on the Canada Revenue Agency (CRA). That it acts as a good pre-percentage of every Canadian taxation that the non-citizen could possibly get sooner or later are obligated to pay. Canada essentially fees non-people to their earnings of carrying-on company inside the Canada. If the a customers are a company and other courtroom organization, a similar information will have to become gathered and you can advertised inside regard of the sheer people who take action control of the fresh organization. Reporting will be expected regarding one another Canadian resident and non-resident consumers.

- When you are resigned to the impairment and you can reporting your impairment pension online 1h, were precisely the nonexempt count on that range and you will get into “PSO” and also the matter excluded to the dotted range alongside line 1h.

- We have twigs located in Arizona, California, Fl, Tennessee, Tx, and in Washington.

- They doesn’t amount your financial allowance, there are an online casino web site to serve your own monetary requires.

- Common Direct try an on-line financial and you may a part away from Preferred Inc., a more than 130-year-old monetary functions team.

- You can also find a couple airport crash boxes, one in the fresh LaGuardia Tower, (Queens Box 37), plus one in the JFK Tower, (Queens Package 269), that can just be activated because of the group throughout these systems.

Taxpayers could have up to June 29, 2024 so you can document a return and pay the cigarette directory income tax. These actions create apply to the fresh 2026 and you may subsequent calendar years. This would allow earliest revealing and exchange of information less than the new CARF and you can amended CRS to take place inside 2027 which have esteem to your 2026 calendar year. Budget 2024 declares the brand new government’s intent to eliminate from the extent of the general punishment supply the brand new inability so you can file a development get back according away from an excellent reportable otherwise notifiable exchange beneath the required revelation legislation.

All the dumps belonging to a company, connection, otherwise unincorporated organization at the same lender is actually shared and you may covered around 250,000. Next, the master plan administrator must separate 250,100 because of the you to definitely commission to get at the utmost totally insured matter you to definitely a plan can have to your put at the you to definitely lender. An employee Work with Package membership are in initial deposit away from a pension package, discussed work for bundle, or other employee work for package that’s not thinking-directed. The newest FDIC doesn’t insure the master plan alone, however, makes sure the newest deposit account belonging to the plan. While the Paul titled a couple eligible beneficiaries, his restriction insurance rates is actually five hundred,100000 (250,100000 x 2 beneficiaries). Because the their share from Membership step one (350,000) is lower than 500,100000, he or she is totally covered.