Exchange-traded finance (ETFs) are one of the most preferred investment things offered by many of the finest money apps. Investing exchange-exchanged money brings a low-rates and you may easier way to diversify your collection, since you can also be access a large pond from root assets in a single financing. Out of carries and you can ties, wide investment allowance, in order to thematic or industry tilts, electronic property, nation and you may regional exposures, ETFs render buyers with additional options to access more segments away from more segments than ever.

ETFs vs. common financing

- There are also ETFs that focus on other investing steps, including bonus development, leader otherwise wise beta.

- The brand new change replaced part of the term identifies just how this type of bonds are purchased and you may obsessed about the market such as stocks.

- Keep in mind that investing in a product ETF isn’t the same as possessing the brand new commodity.

Active ETFs have high dangers and you can buyers shell out a higher administration debts ratio (MER) than for passive otherwise semi-couch potato ETFS. Yet not, MERs for energetic ETFs continue to be below those to possess shared finance. Including, an active thread ETF you will shift their rate of interest susceptibility founded for the current interest standards, instead of just duplicating the interest rate exposure of the standard. Also, a working equity ETF will appear to increase its contact with ties which might be likely to work later, instead of just allocating highest weightings to the people stocks having did better in the past. For example, you might have to pay more cash to help you trading the new offers ones ETFs. This type of ETFs gives reduced guidance in order to traders, who have a tendency to charge much more for trades when they have shorter information; the cost you only pay to shop for ETF shares to the an exchange will most likely not match the worth of for each and every ETF’s collection.

Because the Record Container comes with a number of the ETF’s holdings, this is simply not the fresh ETF’s actual collection. The differences ranging from this type of ETFs or other ETFs will also have specific professionals. By continuing to keep certain information about the new ETFs magic, they may deal with reduced risk one other investors can also be assume or duplicate the money strategy. In the event the other people are able to backup or predict the brand new ETF’s funding strategy, however, this might hurt the newest ETF’s performance. For additional information concerning your unique services and you may risks of these ETFs, find section below.

What’s an excellent Bitcoin ETF? Informed me Simply for Novices

With regards to possessing ETFs, a switch ability to adopt ‘s the Total Debts Proportion (TER), and this means the complete price of carrying a keen ETF for starters 12 months. These types of can cost you sits primarily from administration fees and extra finance expenses, including https://protezsacumraniye.com/forex-fx-meaning-tips-trade-currencies-and-you-may-advice/ exchange costs, legal charges, auditor costs, or other operational costs. If this’s at the supermarket, the fresh shopping center or the fuel channel, a penny conserved its is a cent earned. The same holds true with regards to their assets, where keeping can cost you reduced helps you reach finally your needs sooner or later. Actually small charge might have a large affect your collection because the not just is the harmony shorter because of the commission, you also lose one go back you might deserve on the money used to pay the fee. Technology out of ETFs features empowered traders of all sorts to help you easily and you will conveniently availability one another broad industry exposures, in addition to far more-focused investment in the in past times difficult-to-arrive at places.

In terms of industry visibility, ETFs work such a common money

Other factors, including our personal proprietary webpages regulations and you will whether or not a product or service is offered in your area otherwise at the thinking-chose credit rating assortment, may also impression exactly how and you will in which points show up on the site. As we try to render a wide range of offers, Bankrate doesn’t come with details about all the economic or credit tool or service. Including, the quality & Poor’s five hundred directory could very well be the country’s finest-understood directory, and it forms the cornerstone of many ETFs. Other preferred indexes include the Dow-jones Commercial Average plus the Nasdaq Substance directory.

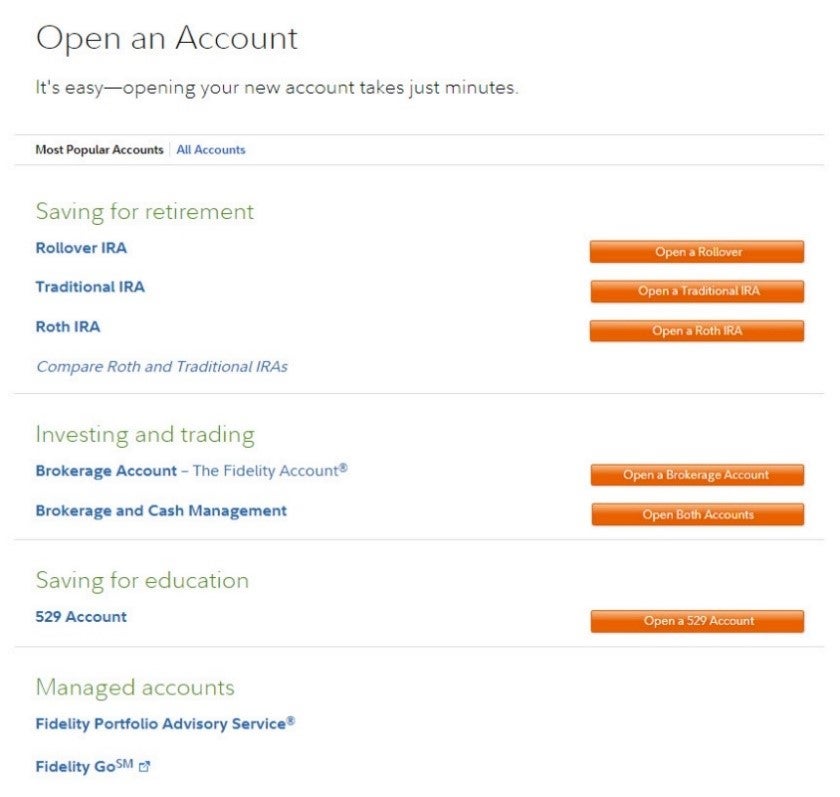

Generally, whenever rates go up, there is certainly a matching decrease in the worth of loans ties. Borrowing risk is the opportunity that the debt issuer often not be able to make principal and you can attention money. The ETFs and index potential give a huge selection of choices therefore traders can also be gather their portfolio playbooks. ETFs is widely available fee totally free of all on the internet broker accounts and you can thanks to funding benefits. You can also get individually as a result of systems for example Fidelity, in which iShares ETFs trade commission-free online. This short article should not be depended up on as the lookup, financing information, otherwise a suggestion of people things, steps, otherwise people protection particularly.

Kind of ETFs/ETPs

ETFs is susceptible to market fluctuation and the risks of its hidden assets. Lots of ETFs provide diversification in accordance with an individual stock purchases. Nevertheless, certain ETFs is actually extremely centered—in both how many other ties it hold or in the newest weighting ones securities. Including, a fund will get focus 1 / 2 of the possessions in 2 or three ranks, offering reduced variation than many other fund which have wide advantage shipping. A collection ETF is constructed in much the same method and you can tend to secure the brings out of a collection.

What is About the newest Surge inside Possibilities Income ETFs?

The firm will then be registered to the stock exchange, like some other organization. You can purchase or sell shares out of an ETF any kind of time day during the an everyday market go out, and also the express speed responds in real time so you can shifting buyer consult and supply-top offers. ETFs along with may have cons against. common financing, such as not necessarily providing fractional investing. Specific ETFs, including of those with niche templates, may also be reduced drinking water than simply particular mutual finance. There are many important differences between shared money and you may ETFs for people to consider also, however the details are different in line with the finance you happen to be evaluating. ETFs and you will mutual finance express particular parallels, however, you can find very important differences when considering those two finance models, especially when you are considering fees.

Electronic possessions show another and quickly growing world, and also the value of the new Offers depends on the acceptance. A disruption of your own websites or a digital asset network do change the ability to import electronic possessions and, for that reason, do effect the really worth. There are a variety of a way to purchase exchange exchanged financing, and exactly how you are doing so mainly boils down to preference. These assets is actually a basic offering one of many on the internet agents, and some significant brokerages dropped its earnings on the ETF positions to $0. To possess people working with a monetary mentor, talk with their coach about how exactly ETFs may help you seek to achieve your financial wants.